oregon wbf assessment employee

Oregon Workers Benefit Fund. It is automatically added by payroll but requires a manual.

Oregon Workers Benefit Fund Wbf Assessment

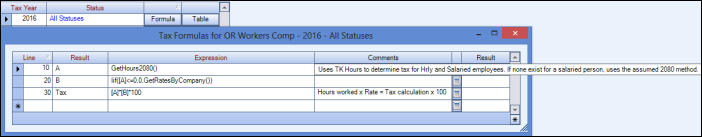

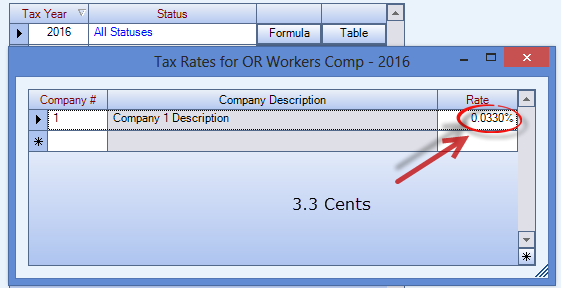

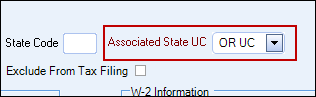

The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation.

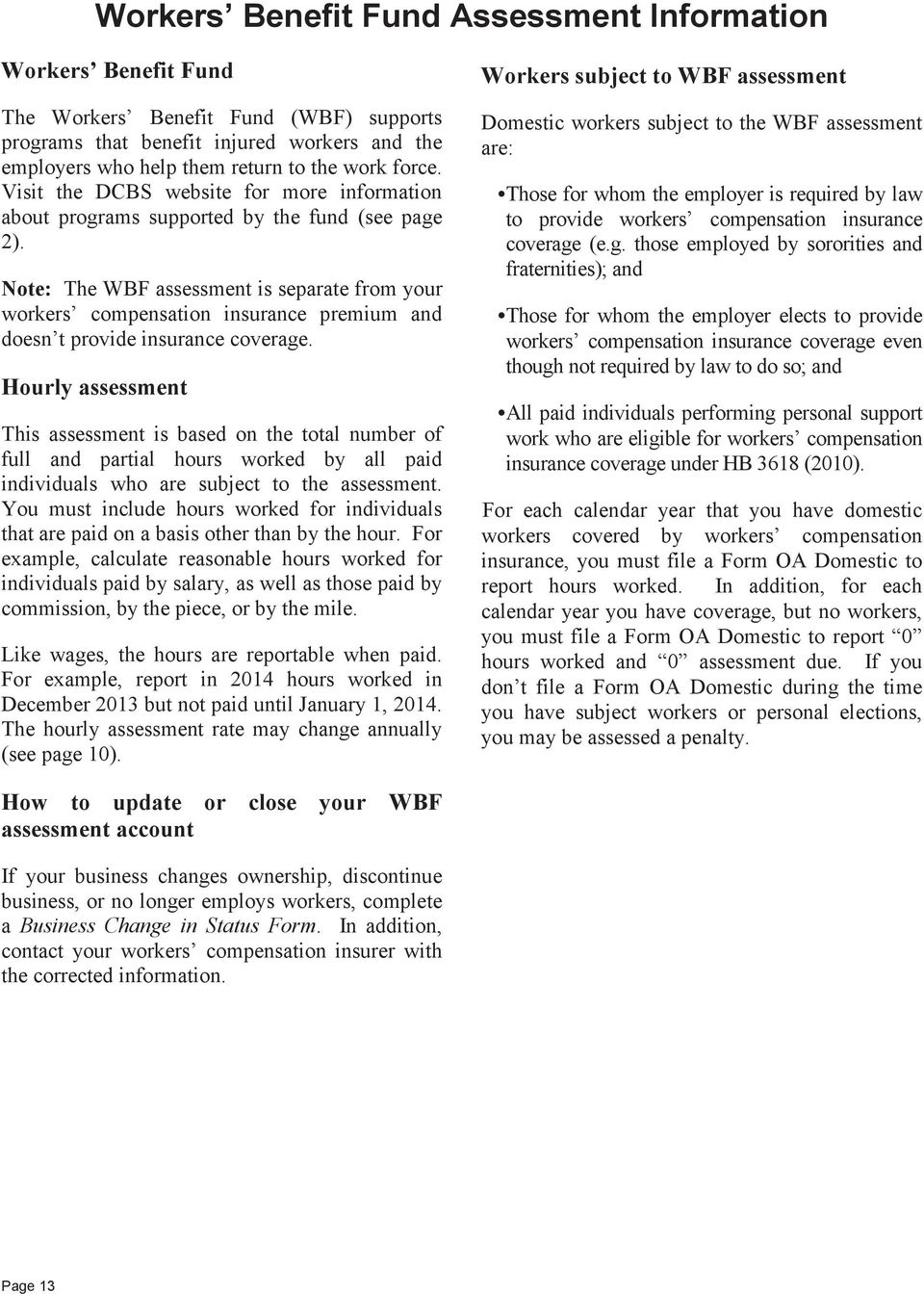

. We are setting up Payroll in version 11 and I am trying to figure out how to do Oregons WBF Assessment. The Workers Benefit Fund WBF assessment this is a payroll assessment. 1 Assessments means the funds due from employees and employers pursuant to ORS 656506.

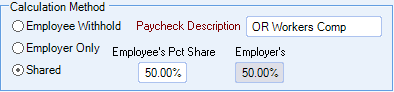

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits. 14 cents per hour for employer 14 cents per hour for employee Any ideas. Compensation programs owcp War.

Click the Other tab and click the OR WBF tax. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled. The Edit Employee window opens.

Wed Oct 08 2003 520 am Location. Set up or change Oregon Worker Benefit Fund. You are required to report and pay the WBF assessment if 1 you have workers for whom you are required by Oregon law to provide.

Click the Taxes button to display the Federal State and Other tabs. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered. May 21 2019 358 pm.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Click the Payroll Info tab. Workers Benefit Fund WBF Assessment Definition.

Let me guide you how. It is figured on of hours worked. Ive added this link for more information.

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers. What is Oregon WBF assessment. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021.

The assessment is one part of the workers compensation insurance. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers. In the Employee Center double-click on the employees name.

2 Employee means a subject Oregon worker as defined in ORS 656005 and any.

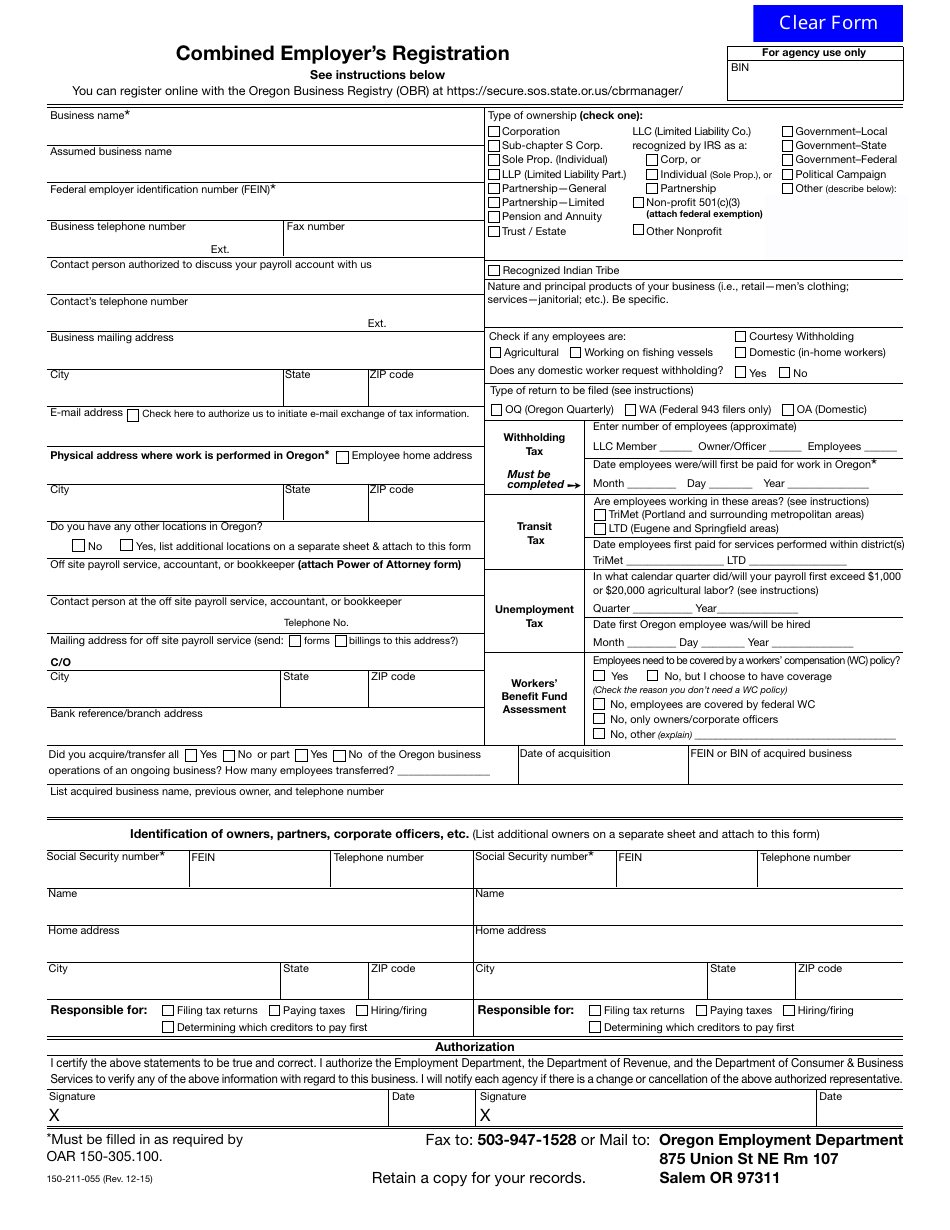

Form 150 211 055 Download Fillable Pdf Or Fill Online Combined Employer S Registration Oregon Templateroller

Oregon Employment Or Job Termination Package Us Legal Forms

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Form 150 211 055 Combined Employer S Registration

Oregon Workers Benefit Fund Payroll Tax

Who Is Exempt From Oregon Wbf Tax

Bin Oregon Fill Out Printable Pdf Forms Online

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Bin Oregon Fill Out Printable Pdf Forms Online

Who Is Exempt From Oregon Wbf Tax

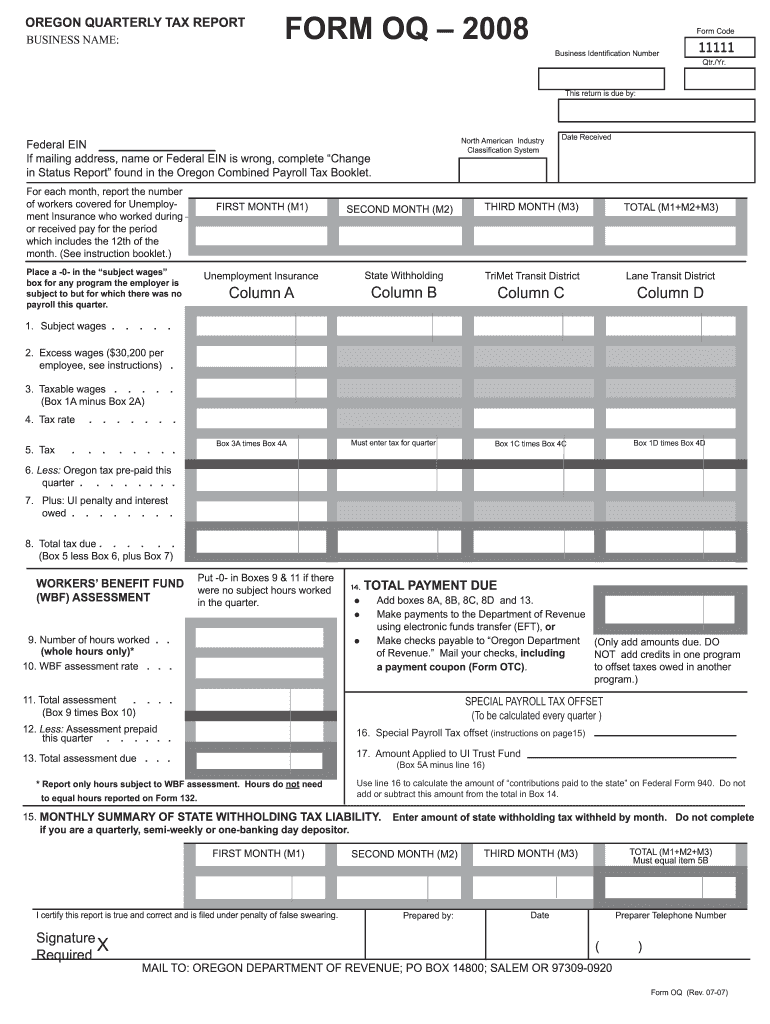

Oregon Form Oq Fill Online Printable Fillable Blank Pdffiller

Oregon Workers Benefit Fund Payroll Tax

Oregon Payroll Tax And Registration Guide Peo Guide

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Domestic Combined Payroll Tax Report Pdf Free Download

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms